Two More Scary Indicators of the Peak Oil Problem

It’s been a while since my last post on the big picture of energy, so today I present to you two more metrics that show we have a serious problem. Peak oil, as I’ve written here before, brings about a supply and demand imbalance long before we actually run out of oil. The problem stems from our looking at the wrong quantity. When we should be looking at rate of oil production, we instead focus on the total amount of oil in the ground. (For the math geeks, it’s our inability to understand the derivative of a function that’s to blame.)

It’s been a while since my last post on the big picture of energy, so today I present to you two more metrics that show we have a serious problem. Peak oil, as I’ve written here before, brings about a supply and demand imbalance long before we actually run out of oil. The problem stems from our looking at the wrong quantity. When we should be looking at rate of oil production, we instead focus on the total amount of oil in the ground. (For the math geeks, it’s our inability to understand the derivative of a function that’s to blame.)

It’s been a while since my last post on the big picture of energy, so today I present to you two more metrics that show we have a serious problem. Peak oil, as I’ve written here before, brings about a supply and demand imbalance long before we actually run out of oil. The problem stems from our looking at the wrong quantity. When we should be looking at rate of oil production, we instead focus on the total amount of oil in the ground. (For the math geeks, it’s our inability to understand the derivative of a function that’s to blame.)

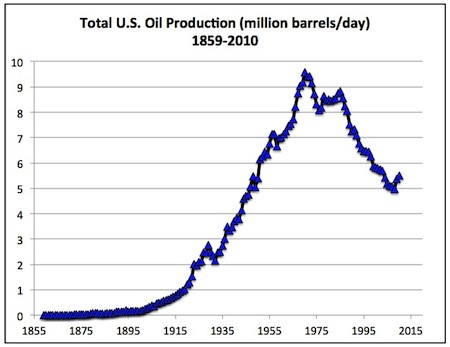

Basically, the problem is that finite resources exhibit a production curve that shows steeply increasing production at first, then slowing increases, a peak, and finally, a decline in production. The United States has gone through its increase and peak. We maxed out in 1970 and, with the exception of the Alaskan oil that came on in the late ’70s and another little blip in recent years, we’re well into our declining period. Here’s a graph that I put together a few years ago using data from the US Energy Information Administration (EIA).

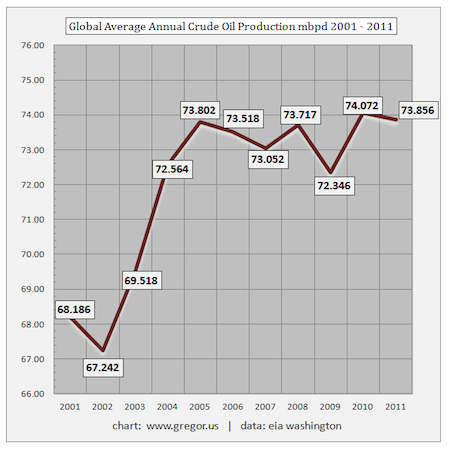

We can drill all we want, but we’re never getting back to our 1970 peak. The big debate lately has been when global production will hit its peak. Some say it’s happened already because production has been stagnant since late 2004. The graph below (from Gregor Macdonald’s excellent site) shows global oil production over the past decade, and it’s clear that we’ve been stuck at about the same level.

With oil production staying steady since late ’04, is it any wonder that we’ve seen the price of oil and gasoline go up so much? If you recall, it was January 2005 when the price of gasoline really started heading up here in the US. It may be hard to imagine, but we were still paying less than $2 per gallon then.

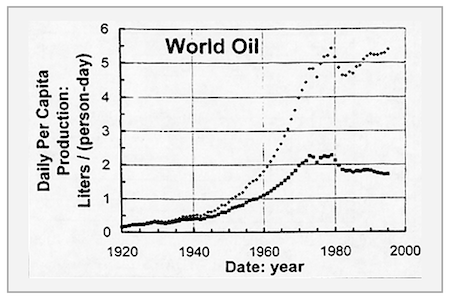

The other metric I wanted to point out is that even when global oil production was still increasing, it hadn’t been keeping up with population growth for the last three decades. Dr. Albert Bartlett, one of my favorite physicists, put together the following graph in a comprehensive article on peak oil. It shows that global oil production per capita peaked in the 1970s. The bottom curve shows actual per capita oil production. The upper curve shows what per capita production would look like if the population had remained exactly the same since 1920.

I’ve pointed out in a previous post that discoveries of new oil reserves are way, way down from the heyday of the mid-twentieth century, and that means there’s not much to hope for in terms of future production increases. This is it. We’ve got to find our way out of this mess by being smart and efficient and rethinking the way we live. Business as usual is over.

Related Articles

Declining Oil Discoveries – The Truth Behind Peak Oil

The End of Growth – Mathematics & Peak Oil

Has the Long Emergency Begun? Peak Oil and the Economic Downturn

This Post Has 15 Comments

Comments are closed.

Allison, are you looking at

Allison, are you looking at the problem being one of energy, or specifically one of crude oil? The alarmists among us tend to conflate the two. They then entertain us with predictions of Hell on Earth, sometimes saying we will end up with totally destruction like Easter Island’s inhabitants.

My own take is the commodity of crude oil is nearly unique but not quite. The category I see is “Liquid Fuels for Vehicles”. Substitutes will be annoying if they reduce energy density, but that can be marginally acceptable. Of course energy sources like coal and gas cannot be used directly, but it is conceivable to invent something from coal or gas, which meets the criteria of an acceptable substitute.

I don’t disagree with these

I don’t disagree with these arguments, but what confuses me about them is I never see anything linking production to consumption. Intuitively, I can image production rapidly increasing, then hitting a plateau and leveling off, but I can’t understand why it drops if it’s the case that new supplies are still there and accessible.

On the other hand, if you told me that the rate of demand increase (clearly driven by population growth) is an order of magnitude greater than the rate of production increase, then yeah, it would make perfect sense to me that rate of production could remain the same, but delivery to the consumer sharply drop.

Anyway, thanks for continuing to publish on this important and quite frankly scary, topic!

M. Johnson

M. Johnson: Peak oil is a liquid fuels problem, as you indicated. It’s a huge problem in itself, though, and the Hirsch Report showed clearly that we’re not anywhere near ready for it.

I meant ‘imagine’…(ugh!)

I meant ‘imagine’…(ugh!)

Oh, yeah. The equation would

Oh, yeah. The equation would be:

dP(t)/dt << dC(t)/dt

😀

A dangerous combination of

A dangerous combination of greed and human denial is keeping our 20th century energy concepts and investments in play. Those of us awake enough to seek a better future should work toward and vote for candidates that advance renewal and renewables even if the ship is sinking.

Good post, Allison. We need

Good post, Allison. We need to keep the big picture in mind. In the U.S. we’ll be hearing about things like insufficient generation capacity in most of the regional compacts. And no doubt we’ll also hear lots of heated debate about offshore drilling, opening ANWR, fracking, and tar sands. The drilling questions touch directly on the peak oil issue, and we’ll hear complaints that it looks like peak oil only because we’re not drilling in sensitive areas. Dang environmentalists. In reality, as the CBO indicates and common sense dictates, we can’t drill our way out of this. (See , for example, http://blog.abm.com/2012/05/efficiency-insulates-business-and-the-country-from-global-energy-price-volatility-why-the-focus-on-drilling-out-way-out/)

We should all make an effort to tease out the facts. We’re not likely to get them enough during the political debate, especially in a crazy election year.

What I can not understand is

What I can not understand is why all of the bright people in the world cannot come up with a system that replaces the internal combustion engine. Not having a ‘Plan B’ is the main cause of a whole lot of problems, just ask the folks who spent weeks trying to figure out how to stop the blowout in the Gulf. The internal combustion engine has been the main power plant for every one of our modes of transportation for 133+ years, one would think we can come up with an alternative.

@Steve: Have you considered

@Steve: Have you considered how very good the IC engine really is? It has proven in various ways better than steam engines, hot air engines, even better than turbines for many applications. There has been a century of testing and improvement, and today’s state of the art is what you get. Barring magic I would challenge you to name a better technology.

@M. Johnson, have you heard,

@M. Johnson, have you heard, we are running out of oil. That was the point of my comment, we need a different operation to make our cars & trucks move. I never said the IC engine was bad, I said it has run its course and it is time to find ‘Plan B’. We need our best minds working on a replacement, not making 133 year old technology better. We will all look pretty silly if we have rockets that will take man to the moon or Mars or beyond, and the common man is riding horses again.

While we dither, Rome burns.

While we dither, Rome burns. Shame on us!

Put your thinking caps on and

Put your thinking caps on and realize that “Energy” is not synonymous with “Crude Oil”. And having to live within a world budget of 70-75 mbpd is not synonymous with running out. Any and all progress made toward 1) using less crude, 2) producing more crude, and 3) substituting another commodity, will legitimately reduce the fear factor in this scenario.

The congress is like Nero and

The congress is like Nero and Trojan horses, making millions from lobbyists, while the US sinks because they legislate policies that are the opposite of science and reason. Are we just talking to ourselves?

When large economic powers

When large economic powers decide to use knuckles in lieu of meetings, we will look back and say, what happened. There are several good serious books about our habits and history, where we repeat postponing corrections and end up with economic and normal wars to corrects issues. My website blogs are about the issues I come across in everyday architecture service, and still today 80% of clients prefer nice kitchen cabinets instead of cutting down energy loss. Even when I say that they would make better return on capital than on wall street…

I don’t suppose any of you

I don’t suppose any of you are paying attention to the 2012 report by the EIA (United States Energy Information Administration). Do I even need to summarize what it says? The change this time is in the direction of *less* fear, not more.

http://www.eia.gov/forecasts/aeo/pdf/0383(2012).pdf