EEM Update – My Friend Perry’s New Home

At the end of last month, I wrote about the house my friend Perry is buying with an EEM (Energy Efficient Mortgage). This is just a quick update about the project. The home energy rater finished up the rating, and, as I expected, the house is really bad. The HERS Index is 192. That means it’s 92% less efficient than the same house built to meet the energy code (in this case the 2004 IECC). Yow! That’s a lot of opportunity.

At the end of last month, I wrote about the house my friend Perry is buying with an EEM (Energy Efficient Mortgage). This is just a quick update about the project. The home energy rater finished up the rating, and, as I expected, the house is really bad. The HERS Index is 192. That means it’s 92% less efficient than the same house built to meet the energy code (in this case the 2004 IECC). Yow! That’s a lot of opportunity.

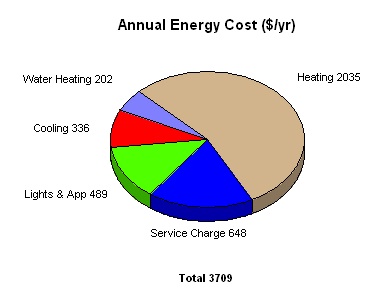

In terms of energy costs, the home energy rating software (REM/Rate) estimates that the home will gobble up about $3700 per year (chart below), more than half of which is for heating.

One of the things that must be done with an EEM is to figure out how much extra money the borrower qualifies for. FHA has rules for this based on the home’s value, the median area price for single-family homes, and Freddie Mac limits. Until last year, there was a cap of $8000 on the amount in an EEM that could be used for energy improvements, but FHA removed the cap.

For Perry’s house, which to me is just crying out for a deep energy retrofit, the limit is $8200. Hmmm. You can make progress with that, but much will be left undone.

They’re still trying to figure out the best energy improvement package for the house, but it looks like they’re going to air seal and insulate the flat ceiling rather than spray foam on the roofline. They’re also going to blow cellulose into the exterior walls but leave the uninsulated vaulted ceiling as is.

Finally, they’re going to install a solar water heater. Because of the generous tax credits from the federal and state governments, this is actually a cost effective improvement.

If you want my opinion – and you’re reading this so I’m assuming you do – that vaulted ceiling should be fixed before they get a solar water heater. See my 5 step plan for solar energy. Invisible foamboard isn’t as sexy as a solar water heater though. The tax credits also make it artificially more cost effective, but hey, it’s going to save them a lot of money on their water heating and get the water heater out of the mud hole under the house.

I’ve got a lot of video from the day of the rating, and I’ll get that edited and posted as soon as I can. In the meantime, watch out for green pirates.

This Post Has 5 Comments

Comments are closed.

With no cap, but only $8200

With no cap, but only $8200 allowed, seems like a cap! Lending needs to loosen and allow payback (with acknowledgment of tax incentives and rebates included) to rule. Also, appraisers need to begin to give the greater value to the projects, so if a Deep Energy Retrofit was allowed and proposed on this house, that added value would help loosen the banks tightness. The banks should look at all the other benefits that will be gained as well. Just like your recent posts states, electric rates are sure to rise, so they need some way of factoring that in as well for a proposed savings.

Yes, there’s a limit, but

Yes, there’s a limit, but what I was trying to say is that there used to be an arbitrary cap of $8000. No EEM could add more than $8000 to the loan. Now the rules make it so that the maximum amount depends on comparing three numbers and taking the lowest.

I agree with you, Jamie, that we need to find ways to allow for better financing tools so homeowners can undertake deep energy retrofits. One way is with PACE (Property Assessed Clean Energy) financing. Georgia’s governor just signed a new law that will make PACE financing available here, and I’ll be writing about that soon.

So exactly what would you do

So exactly what would you do about the uninsulated vaulted ceiling? We have the same type ceiling and in the summer it is so HOT in that room compared to other rooms of the house.

Catherine, what I recommended

Catherine, what I recommended to Perry was to pull up the shingles and install at least R-20 foamboard on top of the decking. Then put the roofing over the foamboard. Continuous insulation eliminates thermal bridging, and foamboard performs much better than fiberglass, too.

You might be able to do something like this with your house, but as with many things, the devil’s in the details, so if you decide to go this route, make sure you get somebody who knows what they’re doing. If the insulation is on the top of the roof deck, you don’t want any ventilation below it.

Folks … don’t throw out the

Folks … don’t throw out the baby with the bath water … there is help available for Perry’s home … I have been lending money for 26 years and I am always amazed that the conventional wisdom on EEM is focused on the simplest aspect of the “available funds for energy efficient improvements” … the reality is that in the Atlanta metro area, there are two great market rate 1st mortgage strategies that Perry could use to fund so much more than the $8,000 figure being discussed … one allows improvements up to approx $43,700, and the other allows improvements up to 50% of the value of the home (based on an after improved appraisal) … so stop throwing the lending industry under the bus … find a true professional and get this deal done so Perry and his family can start enjoying their great old “high performance/energy efficient” home.

If you want details on how these programs could work for you (or Perry for that matter) … feel free to shoot me an email at “thebestloans@bellsouth.net”